Not All Disabilities Are Treated Equally

If a severe disability struck, the kind where it’s impossible to perform life’s most basic activities without assistance, would your clients have enough income to get by?

Traditional income protection would provide approximately 60% of your client’s pre-disability earnings. However, your client’s expenses are likely to dramatically increase should a catastrophic disability occur.

By adding the Catastrophic Disability Benefit (CDB) rider to their individual Disability Income (DI) Insurance policy, clients could receive up to 100% of their pre-disability income to help cover expenses in those types of situations.

The rider offers a minimum monthly benefit of $500, up to a maximum benefit of $8,000 (depending on the client’s income). AND it is in addition to the base monthly benefit.

Together, the rider and base policy benefit replace a higher percentage of a client’s income to help them account for the extra expenses that often accompany a catastrophic event.

What’s Covered?

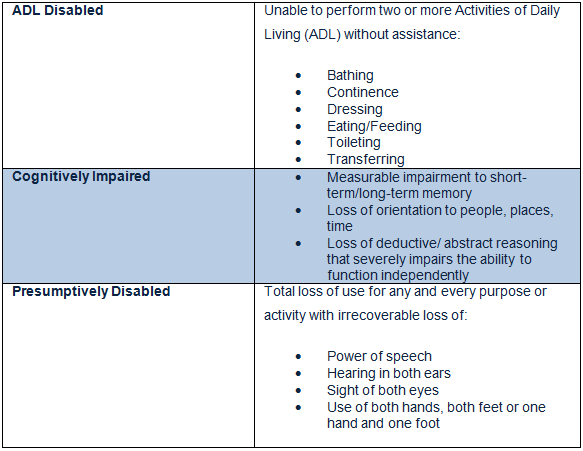

CDB benefits could be paid if your client is ADL disabled, cognitively impaired or presumptively disabled.

Contact your DI Sales Rep to learn more about income protection, and the advantages of the Catastrophic Disability Benefit rider.