Affordable Protection With DI Retirement Security

It can take a lifetime to save enough for retirement – and just a few minutes to deplete it should an emergency strike.

Do your clients have a plan in place should they sustain an illness or injury that affects their ability to work? What would they do if their income stream suddenly came to a screeching halt?

Help protect your clients’ retirement dreams with DI Retirement Security – crafted specifically to replenish lost retirement savings when an individual is too sick or hurt to generate a salary.

DI Retirement Security is an innovative program that helps clients ensure their ability to continue saving for retirement in the event of any type of long-term or total disability. The plan will pay up to 15% of a client’s income for retirement – even if that client has reached the maximum benefit of their current individual DI plans.

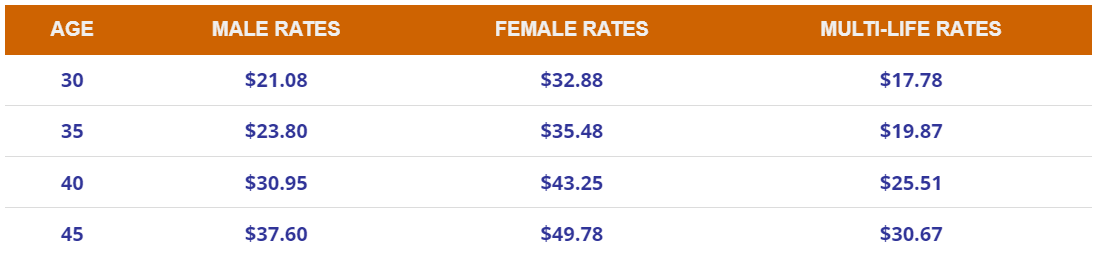

Below are some sample rates* – a small price to pay to secure retirement plans:

A small price to pay to secure retirement plans.

Contact your Disability Income Sales Rep for assistance with illustrations, case design, and product questions.

*Rates from Principal Life assuming CA resident, $1,000/month benefit, 5A-M occupation class, Mental Nervous and Substance Abuse Limitation rider, 180 day waiting period and benefits to age 65. Multi-life rates are for 3+ lives that share a common employer-unisex rates with the 20% Multi-Life Discount. Rates vary by State.