Opportunity Cost of Short-Term Fixed Rates

We’ve been getting a lot more questions on fixed rate annuities (MYGA’s), and some of the recent increases in that space.

A common narrative is that we want to remain nimble and secure short-term rates, as we believe interest rates will increase in the coming years. We thought this would be a good opportunity to highlight what those future increases need to look like, in order to match the current medium duration (5-year) fixed rates.

Short-term interest rates seem more attractive — until you quantify how much rates need to increase by, simply to break even.

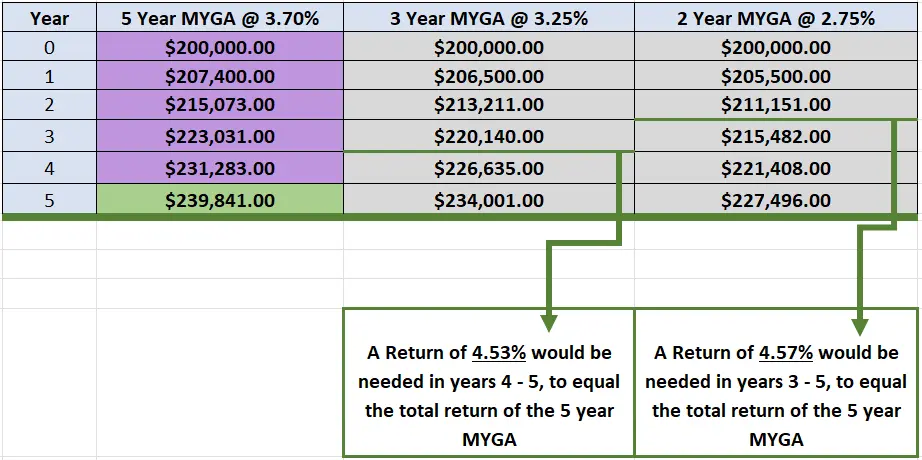

At a glance 3.25% v 3.70% doesn’t seem to be a meaningful difference in yield. However, our analysis shows that the 3.25% yield would need to bump up to 4.53% — just to break even by end of year 5… We were a little surprised by this too.

See below for analysis that we ran on 2, 3, and 5-year fixed annuity rates. The 3-year assumes that interest rates remain the same for all 5 years being illustrated, same is true for the 2-year values.