CPS Impact

Three Questions That Lead You To The DI Sale

Instead of drilling your clients with horror stories about the difficulties they will face without having a DI policy in place, ask them the right questions in order to make the DI sale.

Three Questions That Will Start The Income Protection Conversation

Buy A New Policy And Lower Tuition Cost

FAFSA has certain eligibility criteria that determine, based on your income and net worth, how much you should be contributing to your child’s higher education. If the amount they determine you can pay is too high it renders you ineligible for assistance.

Here is where you can help your clients, especially those with liquid net worth considerable enough that it proscribes or prohibits assistance:

How many clients do you have with considerable amounts of net worth in low-performing assets like CDs?

Indexed Universal Life: The All-Around Product

A product that has gained substantial traction is the Indexed Universal Life policy, a Fixed Life product that can offer clients the potential for growth and protection from market loss.

Product Benefits

Additional Features

Target Clients

- Seeking Life Insurance that offers guarantees and the potential for growth

- Looking for more stable accumulation potential during volatile markets

- In need of flexible death benefit options

- Interested in planning for possible LTC expenses

- 35 to 55 years of age

Underwriting Program Improves Sub-Standard Ratings

Here’s an example:

- Seeking term coverage

- 45-year-old male, non-tobacco

- History of bipolar disorder with occasional minor episodes treated with medication on an as-needed basis – no daily medication

- History of elevated cholesterol with favorable cholesterol ratio of 3.17

- Family history of early heart disease – had a coronary artery calcium score test 3 years ago showing a zero calcium score (no heart disease)

- Favorable height/weight 5’10” 174 lbs. (BMI 25.0)

Open the Door to Small Business Sales

All businesses can deduct LTC Insurance premiums paid using business dollars.

Depending on the tax structure of the business, the owner can either deduct the actual premium or eligible premium. How?

Why Business Owners Should Invest in Disability Buyout Insurance

When a business has multiple owners, Disability Buyout Insurance provides funds to buy out the disabled owner’s share of the business. This ensures that the business can continue operating smoothly without financial strain.

The Importance of Disability Buyout Insurance

Without this insurance, a disabled owner’s share of the business could become a burden, leading to potential disputes and financial instability.

Who Needs Disability Buyout Insurance?

Any business with more than one owner can benefit from Disability Buyout Insurance. Whether it’s a partnership, a corporation, or a limited liability company, having this insurance in place can safeguard the business from potential disruptions caused by a co-owner’s disability.

How Disability Buyout Insurance Works

When a co-owner becomes disabled, the Disability Buyout Insurance policy is triggered. The policy provides the necessary funds for the remaining owners to buy out the disabled owner’s share of the business. This ensures a smooth transition of ownership and allows the business to continue operating without interruption.

Choosing the Right Disability Buyout Insurance

Factors such as the value of the business, the number of owners, and the potential impact of a co-owner’s disability should be taken into account. Working with an experienced insurance advisor can help in choosing the most suitable policy.

Conclusion

Disability Buyout Insurance provides financial protection and ensures a smooth transition in the event of a co-owner’s long-term disability. By understanding the importance of this insurance and choosing the right policy, business owners can mitigate potential risks and secure the future of their business. Contact your Disability Insurance Specialist to learn more.

Avoiding The Gift Tax, But Keeping The Benefits

A song familiar to all tells us that, “Love and marriage go together like a horse and carriage.” Maybe so. But when it comes to finances and marriage the use of the two as grist to the mill of so many matrimony jokes does not suggest such an harmonious coupling. Consider a couple tame examples:

Wife to husband: “I didn’t report your stolen credit card because the thief is using it more wisely than you did!”

Husband to wife: “I think I need to buy you a new bank account. The one you have keeps running out of money!”

Fortunately, fact usually looms larger than the fiction of humor. We find most high-net-worth married couples in full financial tandem, especially when it allows them to move large amounts of net worth out of their joint taxable estate and still keep access to the benefit of the assets after the transfer.

This is done through a common and time-tested planning device most-often referred to as the Spousal Lifetime Access Trust (SLAT).

With the help of legal and tax counsel its implementation and function are as follows:

- The taxpayer sets up an irrevocable grantor trust with intended heirs (usually the kids) as trust beneficiaries.

- In addition, the taxpayer’s spouse is made a lifetime beneficiary of the trust – that is what makes it a SLAT.

- The beneficiary spouse can have the right to withdraw all income generated in the trust each year.

- The beneficiary spouse can have the right to draw 5% of the trust corpus each year.

- The trustee of the SLAT can have the power to make discretionary distributions for the health, education, maintenance, or support (HEMS!) of the beneficiary spouse. And if your trustee can’t justify a distribution for one of these reasons, someone should be appointed who has a better imagination!

- The beneficiary spouse can even be the SLAT trustee who makes the discretionary distributions discussed in #5!

So… a high-net-worth taxpayer can make full use of the current high lifetime exemption of $13,900,000 by transferring that amount to a SLAT for a spouse and still maintain vicarious access through that beneficiary spouse to the benefits of the property gifted.

A SLAT can also serve as the depository for life insurance outside the estate that can assist in payment of any unavoidable death taxes. In addition, legal counsel can be sought to see if a second trust can be used in a marriage to take similar advantage of the other lifetime exemption available to a married couple.

Call with additional questions or to arrange a conference or Zoom call on any planning topic with you and your clients, or their advisors, at Tom Virkler, 706-614-3796, or tom@cpsadvancedmarkets.com.

For What It’s Worth: Considered by many the wealthiest celebrity couple, and thus much in need of estate planning, are actress Salma Hayek and luxury goods CEO Francois-Henri Pinault. Married since 2009, the two share an estimated net worth of around $7.1 billion.

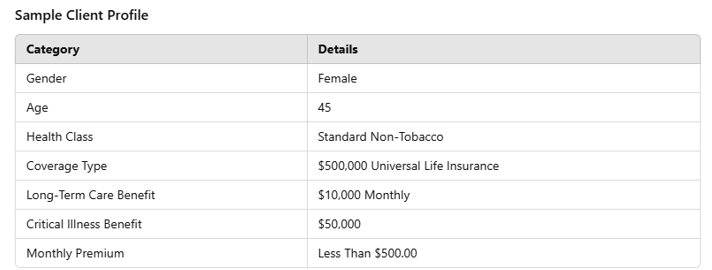

Protection For Life – Benefits While Living!

Do your clients have life insurance that provides long-term financial security while covering multiple needs? If not, it’s time to seriously consider offering affordable permanent life insurance with living benefits that include critical illness, long-term care, and Vitality.

Life insurance with critical illness benefits allow policyholders to access a portion of their death benefit if they experience a qualifying health condition, such as a heart attack.

This can help cover the cost of treatments, care, or other expenses during challenging times. Long-term care benefits ensure that clients can afford necessary care, whether at home or in a nursing facility, without depleting their savings.

Additionally, with Vitality wellness benefits, clients can earn valuable rewards and premium discounts for engaging in healthy lifestyle activities. Vitality motivates clients to take charge of their health by rewarding healthy behaviors. This encouragement can improve their quality of life and reduce the risk of a critical illness or long-term care event.

Let us be your trusted partner in providing comprehensive solutions built to stand the test of time!

Client’s Family History Have You Down? We Have a Solution!

Our Underwriting Team is here to help with all your impaired risk cases.

Here are some examples:

- 67- year- old male

- 5’10”, 190 lbs.

- BP averages 140/84, total cholesterol 218, & Chol/HDL ratio 4.6

- Father died at age 45 due to a heart attack and mother died at age 60 due to advanced breast cancer

- No other adverse medical history in his APS records

- 42- year- old female

- 5’3”, 154 lbs.

- BP averages 130/80, total cholesterol 220, & Chol/HDL ratio 4.2

- Both hypertension and cholesterol are currently being treated with medications

- Father passed away at age 59 due to prostate cancer

- No other adverse medical history in her APS records