Life Insurance Benefits In The Here And Now

In the world of aeronautics, the term envelope is used to describe the performance limits that an aircraft cannot safely exceed. In his book The Right Stuff, Thomas Wolfe popularized the term pushing the envelope to describe the in-flight risks often taken by Air Force test pilots, particularly Chuck Yeager.

Business owners often ask if there are any tax-advantaged benefits they can provide for themselves through their company exclusive of employees. The answer is, pretty much, “No.”

But overfunding a permanent life insurance policy has many attractive features and is an increasingly popular planning device.

On paper it is a simple executive bonus plan.

Premiums that the business pays on the owner’s personal policy can be tax-deductible as compensation, but the same amount must be recognized as income on the owner’s W-2. The policy is maximum funded each year without creating a modified endowment contract (MEC) to encourage as much cash value growth as possible.

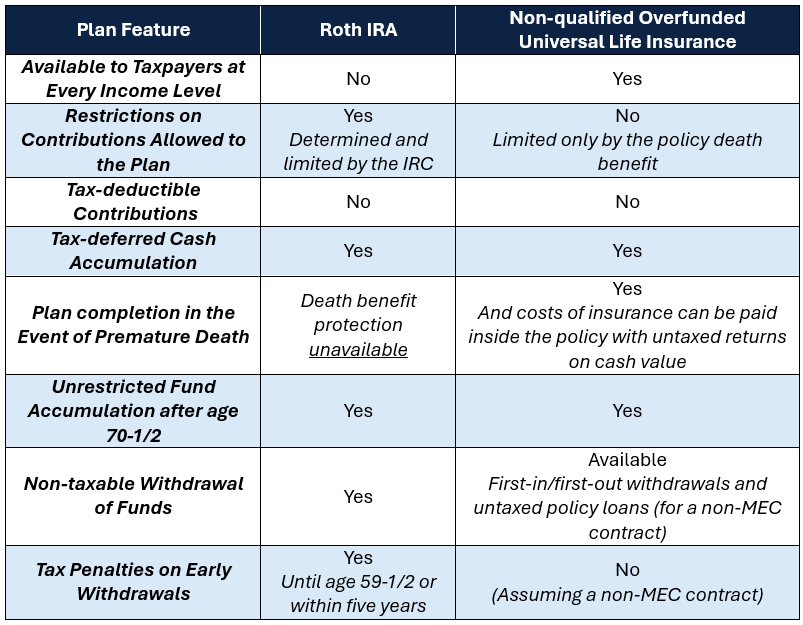

Clients are often discouraged that the contributions are not deductible but usually reconsider when the plan elements are compared to another popular qualified vehicle, the Roth IRA.

Consider:

The temptation to push the envelope can occur in the insurance industry as much as in aviation. Several precautions are in order when marketing and selling this versatile and effective concept:

- Don’t refer to an over-funded UL plan as a retirement plan, or even a retirement plan alternative. It can easily lead a client to believe it is some sort of tax-qualified plan. In addition, it overlooks accessibility to cash any time during the insured’s working life.

- But if a major purpose of the plan is savings for post-retirement needs, make sure the client is taking advantage of any qualified plan opportunities available, including a personal IRA or a personal Roth IRA, if eligible.

- As with any life insurance sale, make no guarantees, especially regarding policy account growth.

- Again, as with any insurance sale, give proper attention to product suitability.

- Illustrate acceptable sales ledger growth prospects and make sure the death benefit/premium balance will achieve optimum account growth. The usual design is a death benefit only large enough to accommodate the desired annual premium level without the creation of a MEC.

Contact tom@cpsadvancedmarkets.com or 706-614-3796 with questions about the use of overfunded UL in owner or non-owner benefit plans, and contact the Life Sales Team for sales ledgers.

For What It’s Worth: Some suggest that “pushing the envelope” derives from the practice of sliding a sealed offer across the table in a business transaction. If unaccepted, one might say that progress on the deal becomes stationery.