The 10-Minute Insurance Analysis

The insurance industry has responded to the fast pace to which a new generation of buyers has become accustomed with abbreviated and accelerated policy underwriting and issuing programs.

The insurance industry has responded to the fast pace to which a new generation of buyers has become accustomed with abbreviated and accelerated policy underwriting and issuing programs.

Consequently the death of an owner is the contingency on which we focus too exclusively when planning.

The Lady and Lord Mucks of the entertainment world understand that they work in a tough marketplace and things simply sell better when they look good.

Business owners regularly protect against the loss of their company’s buildings, equipment, and inventory. They even insure against intangible risks like liability.

But what about their most valuable asset: the key employers who keep the company running profitably, who monitor and keep pace with the industry, and who service and grow the customer base?

Protecting against the financial hardship of losing an executive due to death or disability can be accomplished very simply by insuring the employee.

We will enable you to be at the center of your business clients’ total risk management program by working with you, your client, and their advisors to design, implement, and administer the insurance solutions needed. Plus, you’ll get paid for writing the coverage that funds these programs.

Call today with questions or for assistance with any client or prospect who needs to protect against the loss of valuable personnel: Tom Virkler, JD, at 706-614-3796 or tom@cpsadvancedmarkets.com.

For years, CPS has been synonymous with excellence and innovation in the business world. Yet, tucked away behind the company’s well-known reputation is a game-changing asset that few outside the inner circle truly appreciate: the full-service 401(k) division.

This specialized team has quietly revolutionized retirement planning for a diverse array of businesses, offering expertise and solutions that reach far beyond the industry’s conventional offerings.

CPS’s 401(k) division is not just another service—it’s a strategic advantage for companies determined to secure their employees’ financial futures and optimize organizational performance. By delivering tailored, end-to-end retirement planning, CPS equips businesses with the tools and guidance they need to stand out in today’s competitive landscape. The division’s success is rooted in a client-first philosophy, where every recommendation is tailored to the unique needs of each organization and its workforce.

What sets CPS’s 401(k) team apart is not only its comprehensive approach but also the tangible results it achieves. Generating over $1,000,000 in commissions annually, the division has demonstrated an exceptional ability to deliver value at scale. These impressive numbers reflect a team of seasoned professionals who master the intricate details of compliance, fiduciary duty, and investment strategy. Their deep knowledge ensures every client receives guidance that maximizes returns while minimizing risk—no matter how complex the situation.

In an industry crowded with one-size-fits-all plans, CPS’s 401(k) division stands out for its bespoke solutions. The team works closely with business leaders to design, implement, and manage retirement strategies that evolve alongside each company’s goals and challenges. This proactive approach fosters employee confidence and loyalty, helping businesses attract and retain top talent while reinforcing their commitment to long-term financial wellness.

After years of quietly transforming the retirement landscape for countless organizations, CPS is bringing its 401(k) division into the spotlight. For companies seeking a genuine partner—one that blends financial expertise with relentless client advocacy—the answer is clear. It’s time to move beyond standard plans and unlock a service that delivers measurable impact for your business and your people.

The secret is out—are you ready to take advantage of it? Contact Jim Moore, CPS Vice President of Retirement Services, at 949-225-7145 or jmoore@cpsbenefits.com.

The need for a reliable value occurs often in the business, estate and financial planning process.

The visibility and responsibilities of those in high places often deny them the flexibility and lack of restraint enjoyed by the common folks in the seclusion and simplicity of their more private lives and smaller worlds.

The order of things is essential. The correct order is critical. Fortunately the order and timing of insurance conversions and ownership transfers is less complicated.

As an advisor, you should be aware of and alert your clients to several issues in this marketplace if you are to effectively manage expectations as well as make an achievable sale.

In the world of aeronautics, the term envelope is used to describe the performance limits that an aircraft cannot safely exceed. In his book The Right Stuff, Thomas Wolfe popularized the term pushing the envelope to describe the in-flight risks often taken by Air Force test pilots, particularly Chuck Yeager.

Business owners often ask if there are any tax-advantaged benefits they can provide for themselves through their company exclusive of employees. The answer is, pretty much, “No.”

But overfunding a permanent life insurance policy has many attractive features and is an increasingly popular planning device.

Premiums that the business pays on the owner’s personal policy can be tax-deductible as compensation, but the same amount must be recognized as income on the owner’s W-2. The policy is maximum funded each year without creating a modified endowment contract (MEC) to encourage as much cash value growth as possible.

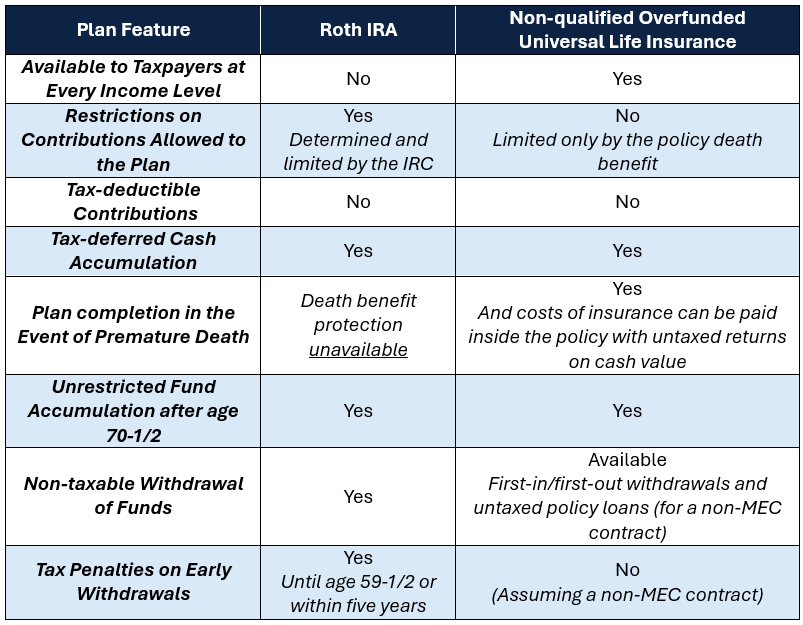

Clients are often discouraged that the contributions are not deductible but usually reconsider when the plan elements are compared to another popular qualified vehicle, the Roth IRA.

Contact tom@cpsadvancedmarkets.com or 706-614-3796 with questions about the use of overfunded UL in owner or non-owner benefit plans, and contact the Life Sales Team for sales ledgers.

For What It’s Worth: Some suggest that “pushing the envelope” derives from the practice of sliding a sealed offer across the table in a business transaction. If unaccepted, one might say that progress on the deal becomes stationery.