How much does an insurance company think that your client is worth? Many times it is much more than your client does, and you have their underwriting guidelines to prove it!

Insurance companies don’t want to over-insure someone. Too much coverage can often result in someone falling down a flight of stairs before their proper time. Carriers set their financial underwriting criteria to limit the amount of insurance someone can buy, not to try to increase the size of the sale. So financial guidelines are a carrier’s attempt to standardize the process for determination of the reasonable worth of an applicant based on their situation.

The most common insurance need among prospects and clients is to replace the income survivors would have anticipated had premature death not occurred.

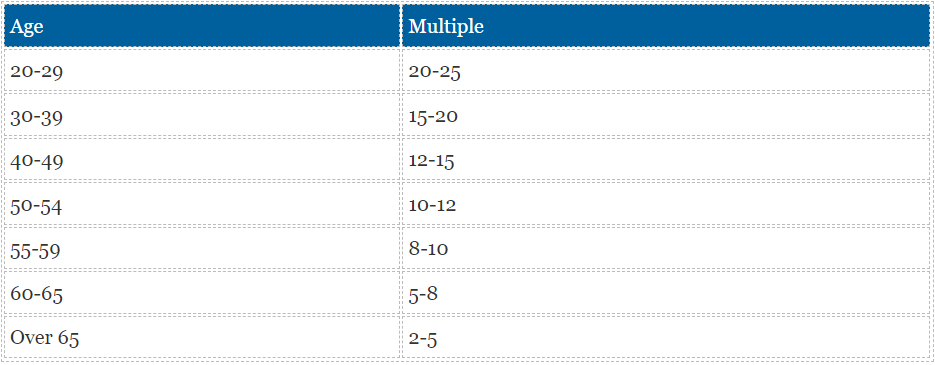

The starting point for calculating the amount of coverage a carrier will issue for purposes of income replacement is determined by a multiple of current annual compensation based on the proposed insured’s age.

The multiple deceases with age, understandably, because death denies a person fewer potential income-producing years as they get older. Multiples vary from company to company.

Consider one of the more conservative examples:

The table can help a client to realistically focus on just how big a pool of money the survivors would need to survive over the remaining years should a wage-earner pass away. And the client can “fatten up” a little in that the compensation figure used is usually the pre-tax earnings which in the calculation process translates into an amount of untaxed death proceeds.

Carriers will usually only take earned income into consideration unless it can be shown that the insured’s death might have a direct affect on unearned income. Non-working spouses can usually get a minimum of one-half the coverage on a working spouse.

At young ages the calculation can result in a large death benefit. But it is what the client needs and if he or she is healthy the competitiveness of current term insurance rates make sufficient coverage affordable to all.

Call with any questions concerning financial underwriting that may arise in case planning or when dealing with carriers.