Super-Roth-Likeness: Does it Walk Like a Duck?

Comedian Steven Wright tells of the time a burglar broke into his apartment while he was asleep, stole everything, and replaced it all with exact replicas. Later his best friend walked in, looked at Steve and said, “Do I know you?”

Americans have never been averse to imitations when the original was unavailable, especially when the substitute still did the job and was more economical as well.

This passion for the more commonplace might help you make sales to clients who have maxed out their qualified retirement options and are looking for an effective way to accumulate more for supplemental income when they no longer work. In this case there is an “imitation” that may be better than the original.

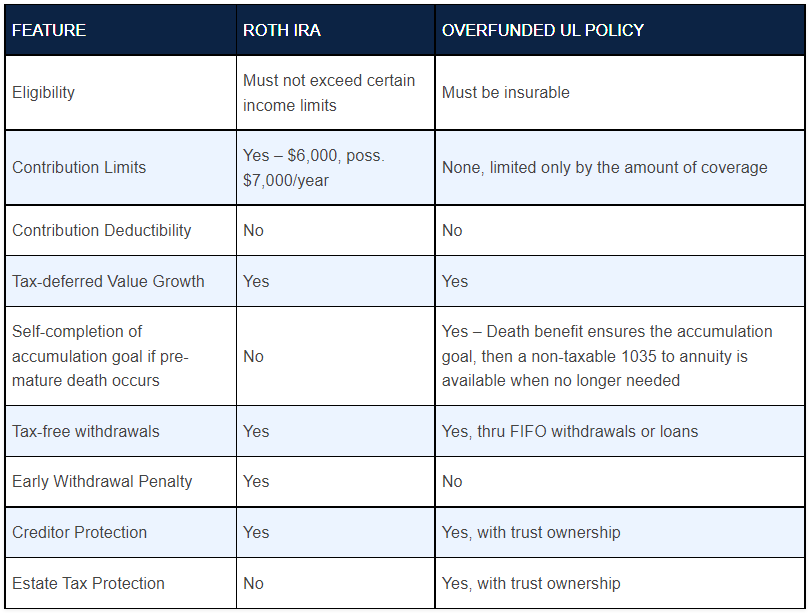

Consider a Roth IRA, best described as “a reverse traditional IRA.” Contributions are after-tax and distributions are tax-free. But consider, too, an over-funded universal life policy that builds significant cash value in later years.

Compare the features and uses of the two vehicles:

The perceived value of an executive bonus plan is greatly enhanced when the policy is designed as an over-funded contract and the possibility of withdrawals to supplement retirement income is highlighted at the time of implementation. But any client is more inclined to consider use of an insurance contract for retirement purposes when the similarities to a Roth IRA, or any qualified plan, are explained.

Speaking of similarities, there is the story of a citrus farmer in the Central Valley who has developed a grapefruit that looks exactly like an orange, except that it is bigger and it is yellow.

Get in touch to discuss how a client’s retirement can be better, or with any other planning questions that arise in your casework, at either 706.614.3796 or tom@cpsadvancedmarkets.com.