Comparing Oranges to Oranges? Almost!

There are reports of a man in Carlisle, Kentucky, who has a grapefruit that he says looks exactly like an orange, except that it is bigger and yellow. His attempt at comparison is understandable given that (if juice sales are an indicator) oranges are 40 times more popular than grapefruit. And it’s hard to settle for a look-alike – that is, unless it does the job.

Business owners who have reached the contribution limits on their company-sponsored qualified plans often seek additional tax-advantaged retirement options through their business. There are none. Benefit costs in pass-through entities will show up on their Schedule K and money retained in a C-Corp for such things is taxed in the corporate bracket.

The biggest asset your clients may have available for their retirement planning could be their insurability!

Consider a planning “grapefruit” that looks remarkably like an orange and may taste as good or better.

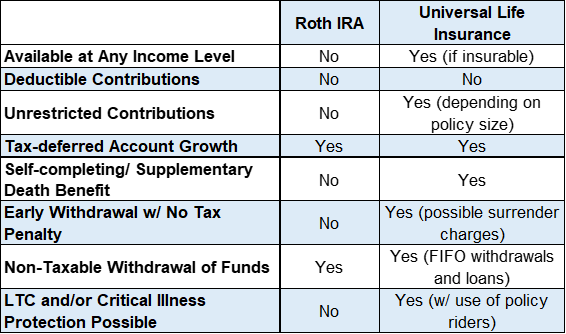

Most clients are already familiar with the Roth IRA concept. Ask them to consider the possibility of using after-tax dollars to purchase an over-funded UL life insurance policy, maximizing premiums without creating a MEC. Compare this strategy to a Roth account:

Call the Life Team today for a ledger illustrating an overfunded UL product with an attractive withdrawal strategy that demonstrates a non-qualified retirement supplement has the juice.

For What It’s Worth: Orange is one of approximately 80 English words for which there is not a true rhyming word. And ripe oranges on the tree are not always that color. In some warmer climates they can be green.